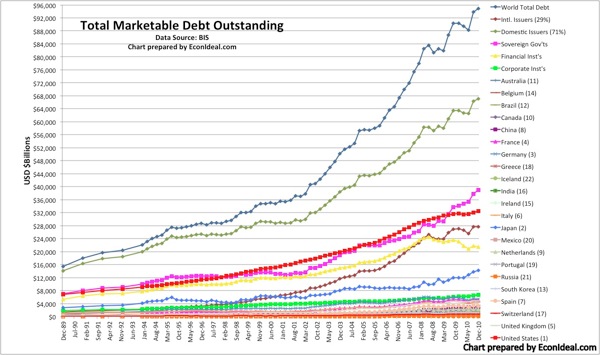

As of Dec 2010, worldwide marketable/tradable debt outstanding neared some USD$95Trillion, according to the Bank of International Settlements (BIS). The historical data above indicates that debt markets have more than doubled from Dec 2002 to Dec 2010, with the largest increases stemming from domestic issuances, at first (2002-2007) from mortgage and asset-backed security issuances, and then more recently (since 2008), from sovereign government issuances. The United States maintains the largest debt market, at some $32.5T, ~35% of the worldwide total market [1].

Gauging and tracking marketable/tradable debt is key to understanding global capital market stability. Though total debt levels can also contain "nonmarketable" debt, such as nonmarketable sovereign government debt, it is the marketable debt that has the greater systemic influence across debt, equity and derivatives markets, since market participants price and trade that debt; however, the influence of nonmarketable debt levels should not be understated. I have started to maintain a "Global Debt Watch" page HERE, with the intent of providing historical trends and data analysis at regular intervals from a variety of international sources.

The fantastic growth in the debt markets has been assisted by three primary factors: (a) the reduced borrowing costs made possible by central bank monetary easing policies worldwide; (b) the aggressive use of short-term funding markets, such as the repurchase agreement (repo) and commercial paper (CP) markets, to borrow cash short and buy longer-dated, higher-yielding debt; (c) government policies that promote debt issuance, and government-sponsored entities (GSEs) that "back" such issuances. Government sanctioned credit rating agencies have also been a factor in the growth of debt markets.

The growth and decline of the repo and CP markets in the last decade coincide with that of the growth and decline of mortgage and asset-backed securities (MBS/ABS) and collateralized debt obligations (CDOs), structured pools of MBS/ABS. The total repo market size between the two largest markets, U.S. and Europe, stood at approximately $12.6T Dec 2010, after falling from a 2008 high of $17.5T [2]. Unlike the CP markets, the repo markets are not reported in the BIS debt data above; repo markets are (usually) very fluid, with the majority of transactions composed of overnight or very short-term maturities. The relative opacity of repo markets, plus their vulnerability to liquidity issues due to collateral quality, counterparty risk and capital cushions, make tracking these markets imperative to gauging stability and "systemic risk." Conceivably, the more transparency in the repo markets, the better able the system would be to handling (greater) market liquidity dislocations, such as that experienced from the credit crisis of 2007/8. However, such transparency does not solve the problem of debt accumulation sponsored by central bank monetary and sovereign government fiscal policies.

[1] The Securities Industry and Financial Markets Assoc. (SIFMA) estimates U.S. debt markets at $35.5T, ~37% of the total worldwide market. SIFMA includes offshore centers and CDOs issued in USD.

[2] I assembled these estimates from two sources, the NY Federal Reserve (Fed) and the International Capital Market Association (ICMA). The NY Fed data only reports primary dealer repos, from a survey of Fed primary dealers, and does not count private OTC repos handled by bank holding companies. That may likely increase the U.S. total by some 30%, according to BIS.

No comments:

Post a Comment