The debate over liquidity deconstructed: creation of quality collateral is not sustainably possible via asset inflation schemes. Value and valuation cannot be consistently gamed and subverted.

A primary systemic risk in the 2007-8 financial crisis was relatively poor collateral underlying highly leveraged instruments. When interest rates rose due to Fed tightening after a sustained period of artificially low rates, those instruments became distressed once a negative equity condition was reached, and perhaps even prior to that condition, based on market anticipation. Duration mismatch for spread bets (borrowing short and lending long) was also an oversubscribed game, adding significant systemic risk. The evidence of these dynamics can be found in the growth of the collateralized debt obligation (CDO) and the repurchase agreement (repo) markets, among other related structured finance, debt and funding/financing markets, including mortgage backed securities (MBS), commercial paper, auction rate securities, etc. - this growth was geometric with a pronounced flare toward the 2007-8 crashes. The growth in these markets coincided with significant inflation in housing and commercial real estate, among other asset classes, and can be characterized as part of the "liquidity" bubble that fueled the asset price inflation, leading to unstable financial conditions, namely a catastrophic failure of structured financial instruments backed by inflated assets that ultimately provided the fuel to ignite other systemically wide failures. In short, parts of the financial system went from highly liquid to illiquid. The same trend occurred in Europe post-2008: from 2008-11 there was a pronounced growth in their CDO and repo markets, and inflation of similar asset classes, as well as sovereign debt. I have covered the data on these clear historical events in prior posts here, located below.

Post crises, the CDO, commercial paper, ARS,..etc. and repo markets were drained substantially and today they are reportedly nowhere near their peaks. What has not abated: the continued issuance of sovereign debt and MBS, setting records [1] in debt outstanding. Corporate debt issuance, both investment grade and high yield, are at record highs [2].

There is a prevailing school of thought that the Fed and other central banks must pump up this liquidity once again, in the case of the Fed by buying Treasurys and MBS (quantitative easing, or QE), and by leading the drive to a zero-bound interest rate environment (ZIRP). This has led to a record growth in the adjusted monetary base (AMB). As I pointed out HERE earlier in the year, this has not yet led to a growth in the velocity of money (VoM) as measured, but it most certainly has and is leading to asset price inflation across many asset classes, namely the U.S. equity and debt markets, which are sharply pegging new highs as I write this missive. In point of fact, all debt markets and related equity proxies are enjoying record price inflation as a result of Fed interventions, investor scrambling for yield/returns in a record low rate environment, and trend trading/chasing by market participants. Indeed, the pendulum has swung in the other direction, and there is even talk of pushing real interest rates further negative.

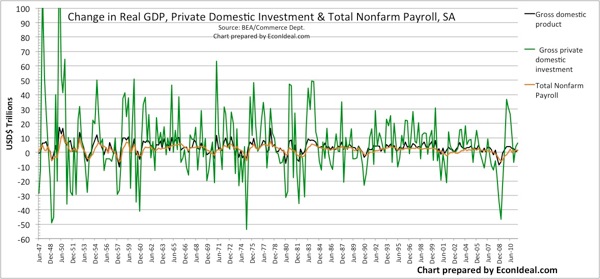

What has given the Fed license in part is the claim that broad inflation is low. However, traditional quantity theory of money (QTM) measures are not providing a useful tool for gauging inflation, particularly asset price inflation, and more to the point, the various funnels of hot money flow as a result of Fed policies and the reaction of market participants to its endogenous lead. QTM monetary measures do not accurately capture newly created monetary equivalents or credit money, or hot money flows. The Fed stopped reporting M3, which tracked repo and Eurodollar flows in 2006, and it has not been replaced by an improved metric. Liquidity as measured by new money equivalents, credit money and hot money flows that lead to asset price inflation are not part of any tracked metric. The AMB and excess bank reserves do not clarify the entire picture, and snippets such as margin debt have limited use, though these measures are again at the peak levels seen in 2000 and 2007. The view of some is that we remain in a "liquidity trap," that there is a dearth of borrowing and a propensity toward deflation. The reality is that we are coming off a significant era of inflation through disinflationary deleveraging, with a Fed providing a growing liquidity floor that has led to those funnels of hot money flow, record debt issuance by corporations and the sovereign, and asset price inflation. By inflating assets, collateralized debt and derivative instruments and collateralized funding markets become unstable if those instruments and markets are backed by inflated assets - enhanced by risks such as interest rate (duration) risk, among other risk factors. No amount of gaming or subversion of value and valuation of those assets will change this outcome. This is not sustainable, and nor is the issuance of "quality" debt at record low and lower rates. Broad real economic growth has been stagnant in the era of driven ZIRP, with asset price inflation providing a cheap high that has further systemic costs.

The point I want to leave the reader with is that the Fed and economic participants cannot create quality collateral via inflation of assets. Yet they keep trying to play this game, over and over. QED

[1] Data on issuance and outstanding levels of sovereign debt can handily be found at SIFMA for U.S. Treasurys and the BIS for ex-U.S. sovereigns. Data on issuance and outstanding levels of U.S. and Eurozone MBS and other structured debt instruments can also be found at the SIFMA link.

[2] Data on issuance of U.S. and ex-US corporate debt can be found at the SIFMA and BIS links above. The strong upward trends to net issuance and amounts outstanding are quite clear from 2010-12, with 2013 likely setting new records.